About 10 years ago, I offloaded 7 negatively-geared investment properties in a “fire sale” that cost me $300K. Sounds like a disaster (and it felt like it too). But changing my strategy to Positive Cash Flow Property was the best thing I ever did and it resulted in me leaving paid employment after just 13 months. So why is negative gearing an anathema to home ownership and financial freedom? Check out my chat with Savings.com.au below, as I and the nation’s top experts break down what would happen if we abandoned it all together.

What would happen if negative gearing got the axe?

By Harrison Astbury, Savings.com.au, August 06, 2020

Negative gearing tax concessions are a particular public policy pain point thought to affect housing affordability, but what would happen if they got the axe?

Negative gearing, in the context of property, is the process of having an investment property that makes a loss on rent. That is, all the outgoings of your interest costs via your investment loan and property upkeep outweigh what you earn in rent. This loss can then be written off against your income at tax time, so you can reduce your tax bill at the end of every financial year, or in many cases receive a sizeable tax refund.

The topic reared its head at the 2019 federal election, when then-Labor opposition leader Bill Shorten made axing or changing negative gearing – among other ‘tax loopholes’ – one of his key policies. The theory was it would reduce the financialisation of housing in Australia, opening up more affordable options to make it easier for first home buyers to get their foot in the door. However, the proposal was controversial, and Labor did not win that election.

‘Negative gearing’ is still a hot topic today, and it’s arguably the number one tax policy thought to influence house prices across Australia. So, what would happen if negative gearing tax concessions for property got axed?

SCROLL DOWN for my take on why Negative Gearing is never a sound investment strategy.

What would happen if negative gearing got axed?

Experts say scrapping negative gearing is not the ‘be all/end all’ like some pundits might have you believe. Some say there needs to be a broad re-think of the entire property tax framework, while more vocal critics of negative gearing tax concessions believe it’s the long term effects that ruin housing affordability for future generations.

Negative gearing not the nail in the coffin

DiscoverWealth partner and financial adviser Lachlan Anderson said the effects of scrapping it might not be as sharp as commonly perceived.

“The short answer is two things will happen. First, a rise in rents because investors will no longer be comfortable losing $5,000 to $10,000 every year if a tax refund will not compensate,” he said.

“Second, there will be a short-term drop in house prices as some investors who believe they can no longer keep juggling all of the balls of an investment property look to offload quickly.

“It will be short-lived however, because there is plenty of wealth in Australia and very low interest rates to make property investing still worthwhile for those who have the capital to make it work, negative or not.”

Tax policy changes shape

Ian Ugarte, co-founder of property investment training platform ‘Small Is The New Big’, said negative gearing was originally introduced as a means to reduce rents across the country.

“However, investors started using property as a commodity to get their tax back, which increased the demand for property investments,” he said.

“This heightened demand increased the prices of investment properties, since supply started shrinking.”

“Either way, it’s ingrained in the Australian psyche to believe that property investment is a safe and stable investment.

“As a result, even if the government were to limit access to tax benefits through negative gearing, investors would find other ways to create cash flow from properties, so as to be able to continue purchasing them.

“It’s likely that any resulting property price (and resulting rental price) stagnation would be short term only.

“Once demand for investment properties returned, this demand would again drive up both property and rental prices.”

Mr Ugarte also pointed to the relatively low housing supply in Australia as further reason that removing negative gearing would potentially have little effect.

READ MY BLOG about how I escaped the negative gearing trap HERE.

A look into the crystal ball

Reid Swift, director at Spectrum Financial Solutions, said if axing negative gearing were to work, it would need to be grandfathered so as not to affect existing investors and to be the most “politically palatable”.

“Short term, there will be a downward pressure on house prices due to the reduced demand for property,” he said.

“This would be offset to a degree by a mini-rush of property investors looking to secure a negatively geared property before the change.

“Longer term, I don’t expect negative gearing changes to have much of an impact on the property market.

“Market forces will prevail as supply meets demand. The banks’ credit policies and general housing affordability are far more influential long-term factors on the market.

“It must be remembered also that around two thirds of property sales are to owner occupiers who won’t be affected by these changes.”

Mr Swift also said rents would rise due to upward pressure, and investors will hold onto properties for longer, causing a lower property turnover rate.

“Investors will always seek safe-haven investments, like bricks and mortar, to include in their long term diversified portfolios,” he said.

Increased rent argument ‘debunked’

Leo Patterson Ross, chief executive at the Tenants Union of NSW, says the belief that tenants commonly hold regarding negative gearing affecting rents is like Stockholm syndrome, covered extensively in this blog post.

“Claims of [scrapping] negative gearing increasing rents during the 80s have been well and truly debunked over the years and bare no relation to the reality of what happened,” he told Savings.com.au.

“Negative gearing, by encouraging speculation and taking on excessive debts, likely contributes to a decrease in lower rents, and decreases the political will to spend money on genuinely affordable housing.”

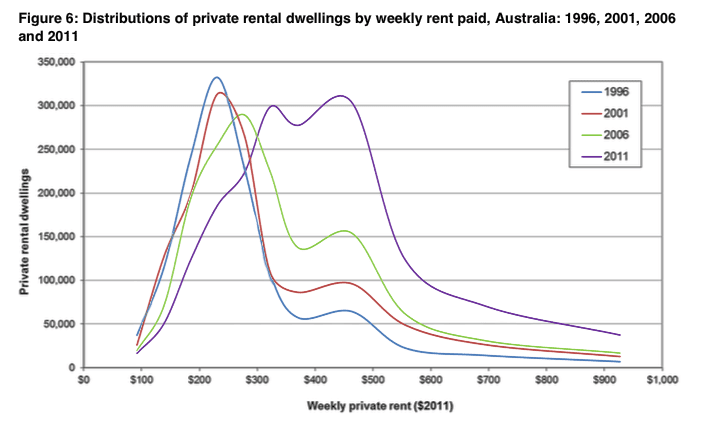

Analysis by the Tenants Union and the now-defunct National Housing Supply Council revealed that negative gearing from 2001 to 2011 created a shift in decreasing availability of housing below $278 a week i.e. affordable housing. Conversely, it also pushed more housing stock up above the $370 a week range.

It also increased ‘supply’ of landlords, with the number of Australian landlords growing by 85% over the past 15 years.

There’s been a 400% increase in people holding six or more properties who are negatively geared.

However, the blame does not directly lie on negative gearing, rather its indirect effect – in lieu of other beneficial tax treatments – promoting the decline of affordable housing supply, according to Mr Patterson Ross.

“Australia spends an enormous amount of money on this tax-delivered income support and, apart from the property owners who benefit directly or indirectly, we get little in exchange,” he said.

“[It is] worth noting also there are no requirements that negatively geared properties are of a good standard or that recipients follow good or even legal practice in their provision of housing.”

Who wears the cost of negative gearing?

Recently, the Australian Tax Office released data on the 2017-2018 financial year and revealed negative gearing ‘cost’ the budget $13.1 billion.

That is, landlords collectively saved $13.1 billion in tax via their rental properties in that timeframe, which otherwise could have gone to Government coffers.

This represented a value increase of nearly 7% over the previous financial year despite the number of people making a loss increasing just 1.6%.

The ATO’s data also revealed that approximately for every one positively geared property in Queensland, there were two negatively geared ones, while more than two thirds of the 340,000 rental properties in Western Australia are negatively geared.

Lower numbers of affordable housing stock has also resulted in a decline in home ownership among 25-34 year olds since 1981, according to the Grattan Institute.

Those in the bottom fifth of income had their home ownership rates decrease from 63% to 23% between 1981 and 2016.

Grattan’s study also found median home prices have increased from about four times the median income in the early 1990s to more than seven times median incomes (more than eight times in Sydney).

The International Monetary Fund (IMF) rates a house price to income ratio of more than six times as ‘severely unaffordable’.

In March, the IMF found that in Sydney and Melbourne, the debt to income ratio was 40%, and recommended tax reform, including axing stamp duty, introducing a land tax, and imposing a surcharge on vacant properties or investor-only house transactions.

What’s the solution to housing (un)affordability?

It’s difficult to appease both sides of the negative gearing argument. However, there have been some other solutions put forward to keep housing investment strong in Australia, while reducing barriers to first home ownership.

Samuel Philipos, managing director at Benevolence Financial Group, said negative gearing allows investors to grow their “abundant portfolios” while also “trapping” would-be first home buyers in a rental cycle.

“The government should begin to introduce schemes that make buying more affordable,” he said.

“For instance, the NSW state government recently announced the abolishment of stamp duty for new homes under $800,000.”

Other states, such as Queensland, waive stamp duty for first home buyers with property prices under a certain threshold. In Queensland’s case it’s $500,000, which is about $120,000 less than Brisbane’s median at the time of writing. Buyers must also hold on to their property for at least one year.

However, Mr Philipos was reticent to recommend axing negative gearing entirely.

“Ultimately, while the benefits of removing negative gearing may seem tempting, if negative gearing is axed, it won’t just be housing affordability and rental costs that are affected, but the economy, various industries and employment rates, too,” he said.

“Removing purchasing barriers like stamp duty, lenders mortgage insurance and other costs mean that first home buyers now can enter the market with minimal savings.

“Furthermore, investors will still have the ability to purchase properties, increasing the supply of rental properties and assisting in keeping rentals capped.”

Modelling from the Australian Housing and Urban Research Institute (AHURI) promoted a stricter cap on deductions as a potential solution.

Using data from the Australian Bureau of Statistics, AHURI calculated if the maximum cap was $5,000, it would add approximately $1.73 billion to the Government’s bottom line and increase the average negative gearer’s tax by $921 every year.

AHURI also put forth a progressive rental deduction scheme, similar to marginal income tax brackets. Those in the third quarter of wealth percentiles would be able to claim only 50% in rental deductions, while those in the wealthiest quarter would not be able to claim anything.

Savings.com.au’s two cents

Depending on what side of the coin you land on – investor or would-be first home buyer – negative gearing can either be portrayed as a blessing or a curse.

Potential solutions that have a reasonable chance of appeasing both sides include changing or axing stamp duty, and having a progressive approach to tax deductions on rental losses with a ‘grandfathering’ policy.

Once in the property market, negative gearing sounds like a great thing. However, the experts – including the critics of negative gearing – say it’s generally better to positively gear your property if you can.

For first home buyers, it’s easy to point the blame solely at negative gearing as reason for unaffordability. However, other tax hurdles can also contribute to high barriers for entry, such as stamp duty, which is generally an unfavourable tax no matter what side of the coin you land on.

In the end, axing any type of preferential tax treatment – that a large voter base has enjoyed for so long – is going to be difficult and controversial. Regardless, first home buyers might want to look at the bigger picture. A large portion of that picture may just be a simple case of supply and demand at work.

JOIN MY UPCOMING WEBINAR to learn how you too can escape the negative gearing trap and invest in positive cash flow property that returns up to 2-3 x typical rents.