3 myths about property investment hot spots and why warm is way smarter

I’ve been in property investment for 30 years, and I can say, without hesitation, that buying into a “hot spot” to make money is a myth. Sure, those “hot” headlines feed our national obsession with real estate. And they grab eyes and ears for media companies. But all they’re doing for buyers is provoking a big FOMO-fueled frenzy.

As I said in my interview with Adrian Franklin for Ticker HOME, hot-spot talk is creating a mindset among those who aren’t in a position to buy, that they’re losing out. Which stimulates demand. In those hot spots the experts have identified (and they do exist), prices have been pushed up.

That makes it even more impossible to afford property there. And for those of you who do pull out the stops and invest in a hot spot, you’re paying more than you should.

Focus on the cold, soon-to-be-warm spots

My belief is that by the time the average buyer is ready to get into the market, it’s already too late to buy into a hot spot. It’s like betting on a horse that’s already won its race.

It doesn’t make sense to base your property investment decisions on the constant ebbs and flows that you read about; or to be wrapped up in a frantic “location-location-location” race. Of course location is still really important, but what I’m saying is let’s apply a bit of market intelligence. Let’s look for the cold spots that lie around the hot spots, which inevitably are heated up by the hot spots. To make warm spots.

SCROLL DOWN for my tips on how to find warm spots and reap the rewards.

I think I can explain that better

Imagine you’re sitting on your parents’ three-seater couch. Your parents are at one end and they’ve got the portable heater blasting straight at them. So after a time they start to cook. At some point, your mum’s going to look at your dad and say, “Colin, this is way too hot.”

Meanwhile you’ve been sitting at the other end of the couch, slowly getting warmer. When dad spins that heater towards you so they can cool down a bit, you start to heat up. Even though the heater’s at the other end of the couch, you’re still getting that heat. And you’re feeling the second-hand temps your parents are now conducting. That’s a good outcome, (even if using your parents as heat conductors sounds a bit wrong). You’re not in front of that heat blast, but you’re getting the benefit.

Investors get it wrong all the time. They want to sit on mum and dad’s lap rather than at the end of the couch. Moving from the couch analogy back into the property market, what I’m suggesting is that you look at the cold suburbs that surround the hot spot. A cold spot will become warmer because of the proximity to the hotspot.

Finding the warm spots

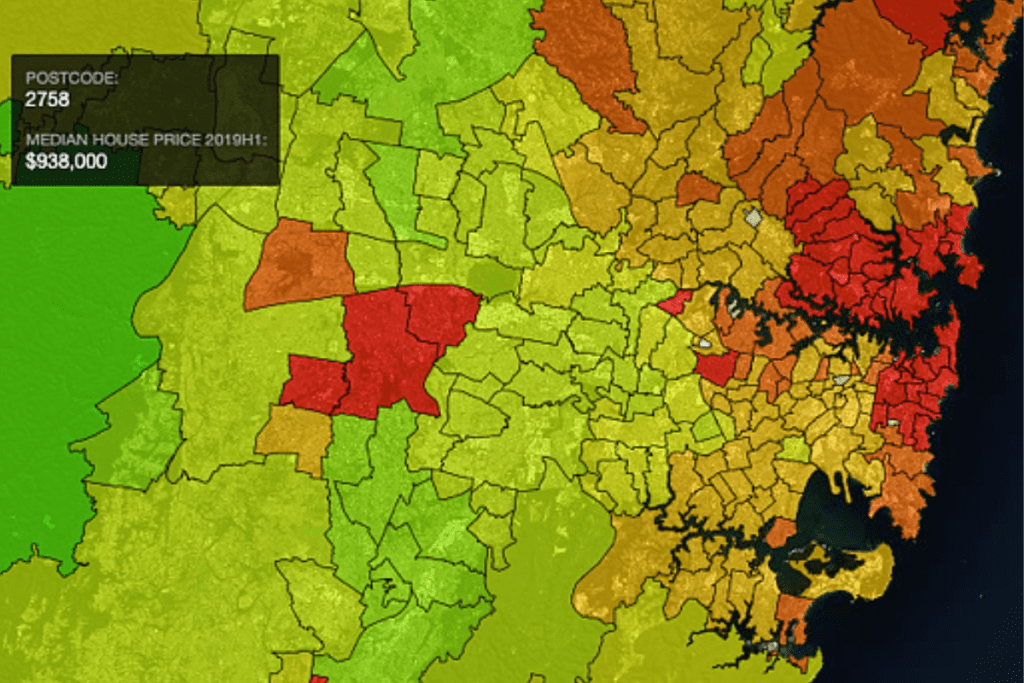

Try googling ‘property heat map’ in your state. What comes up is a map coded by median house price with colours ranging from blue or green, denoting cold, all the way up to red, which is hot. Looking at the red spots, where are the yellow and orange spots around them?

An alternative to heat maps of course is acting on that sure-fire tip your dentist or work colleague or taxi driver gives you. “This suburb is going through the roof,” they say. Still you need to go and research the heck out of that postcode. Find areas close by and then look at their historical median data.

I find ‘days on market’ is a really useful tool. If you go to daysonmarket.com, you get a simple graphic representation of how long it takes for a property to sell in a certain suburb. 100 days on market or more indicates it’s a cold spot. When it moves down to 80 days, that’s when you start doing more research; and when it’s at 60 days – pull the trigger. That’s your warm spot – and your sweet spot. It’s like a honeyed tea that’s cooled to drinkable.

So what’s a hot market? I say 40 days or less. In some markets at the moment, you’ll see seven days or less on market. Ay Caramba! Stay away from those properties, they’ll give you a nasty burn.

Instead of hot spots, follow infrastructure

When it comes to property investment, I strongly urge you to do your research and follow these two trends.

First, look where the government is spending millions and billions on infrastructure. That’s where you’ll get your best investment outcomes. Try – if they’re spending like crazy, it’s usually because their teams of analysts have circled areas for major future growth.

If the government is building a hospital somewhere, that will also stimulate population growth. It will bring construction workers into the area, and once it’s built, you’ve got all the healthcare workers wanting to live nearby. So it’s important to think about high proximity to employment areas, and the spots where supply isn’t going to meet demand.

Even researching where Bunnings is is a great indicator. A business like that pays good money to understand where the demand is going to be. It’s all a supply/demand equation.

SCROLL DOWN for your FREE Report on Property Investment Trends and Opportunities

Don’t confuse government and private infrastructure

Those housing estates that continue to pop up kilometres outside of the CBD where farmland once stood – they’re supported by developer infrastructure. In that scenario, the developer has put in roads and power and sewerage and cut the property up into the smallest pieces of land possible, with a view to creating their own wealth. They’re not interested in your property investment goals, even if they do talk about “growth corridors” and spout impressive marketing numbers. Chances are values in those areas may not rise for 10 or 20 years.

If you were to ask any of these developers whether they had invested in one of their own packages, the answer would probably be no.

And finally, look for established areas

We’ve seen house prices double in Australia every 7 to 10 years. What that means in reality, is that while the house itself might have reduced in value, the land has gone up. So if you’re buying a house and/or land that’s adjacent to hectares of undeveloped farmland, that means there’s opportunity to put more land on the market in the next 10 or 15 years. So your land value is not going to grow.

The way to do well is buy in an established area where there’s a shortage of land. I’ll use an example.

Where I live now, on the Sunshine Coast, the demand is incredible. For younger people, whether they’re renting or buying, it’s devastating because now it’s a hot spot and it’s completely unaffordable.

When Alex Brewster pointed out the best buys in an article about the Sunshine Coast, all the suburbs listed are in established areas. There’s not one mention of the huge estates being created in the corridor down the southern end of the Sunshine Coast.

Ultimately, hot-spot talk is mostly marketing spin designed to suck people in. It’s the research, the resources and the tools you use to create smarts, that will earn results.

WANT MORE INFO? Start by taking full advantage of our Trends and Opportunities Report, and our other market reports, and free webinars.

Sorry what is it you are offering. I am interested in converting my home to allow for a better living structure. Is this something you manage?

Hi Tyron – we can convert your home into income earning micro-apartments. or we can teach you how to manage the process yourself. to find out more, join my webinar HERE