7 factors affecting property market trends in 2021

After a year of ups and downs and contradictions, the loud question on everyone’s lips is what effect the events of 2020 will have on the Property Market Trends for 2021.

The effects of COVID-19 have seen us on a roller-coaster of differing opinions about the economy and what will be in store for the coming year.

Both investors with existing property portfolios and those looking to move into the market for the first time face more questions than answers.

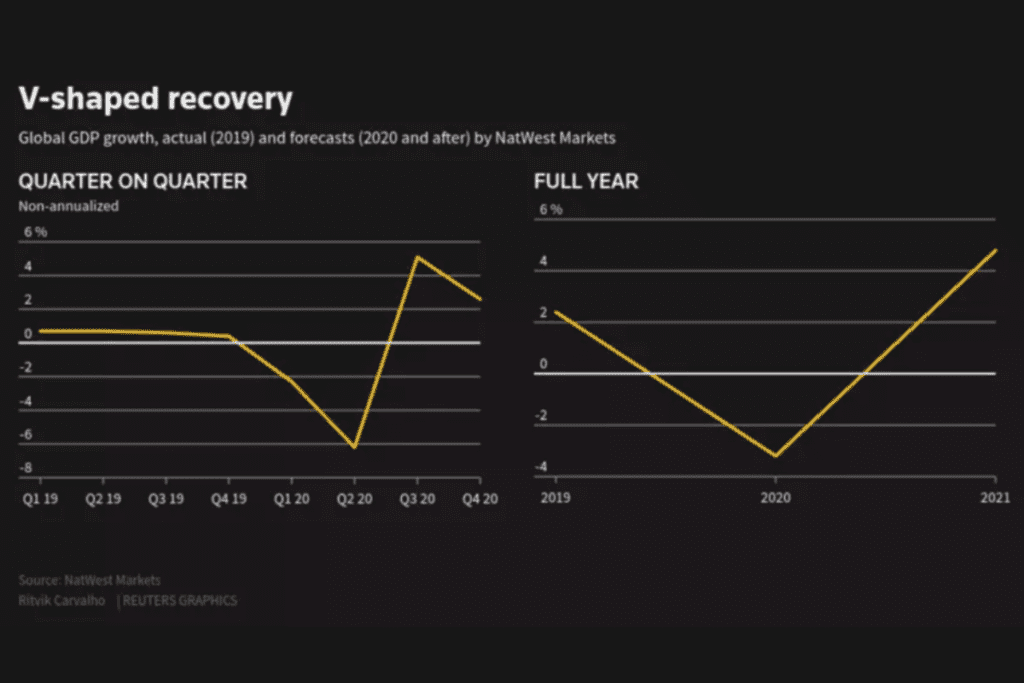

From the beginning of the Coronavirus announcements, even before there was any talk about lockdowns, I suggested that we would see a decrease in property prices and a dampening of market sentiment, followed by a rapid rise back to confidence.

If you’ve listened in on the episodes of my webinar series ‘Matter Of Fact’ (which you can catch up on here), I’ve maintained that the story won’t be the ‘doom and gloom’ that has been portrayed generally in the media and by many property ‘experts’ and economists.

For example, at the pandemic’s peak, the CBA’s economics team said that the slide in property prices nationally would be an average of 10 percent. Still, recently, economists have done a double flip of their initial forecasts of a 10 percent decline to a rise of 9 percent in 2021.

Elongated election campaign

I liken the trend we have seen so far in the property market during COVID-19 to an elongated election campaign and the housing landscape we witness during those periods.

Typically, when an election is announced, there is a pullback in the market, and mostly, the only properties selling in that six weeks prior are those listed by vendors who are desperate to sell.

Because their properties are offered at a low price point or with conditions leaning in the buyer’s favour, it essentially becomes a buyer’s marketplace.

People wait for the election results before they make their move into the market, and then, within that next six week period, there’s a return of confidence, and the market bounces back.

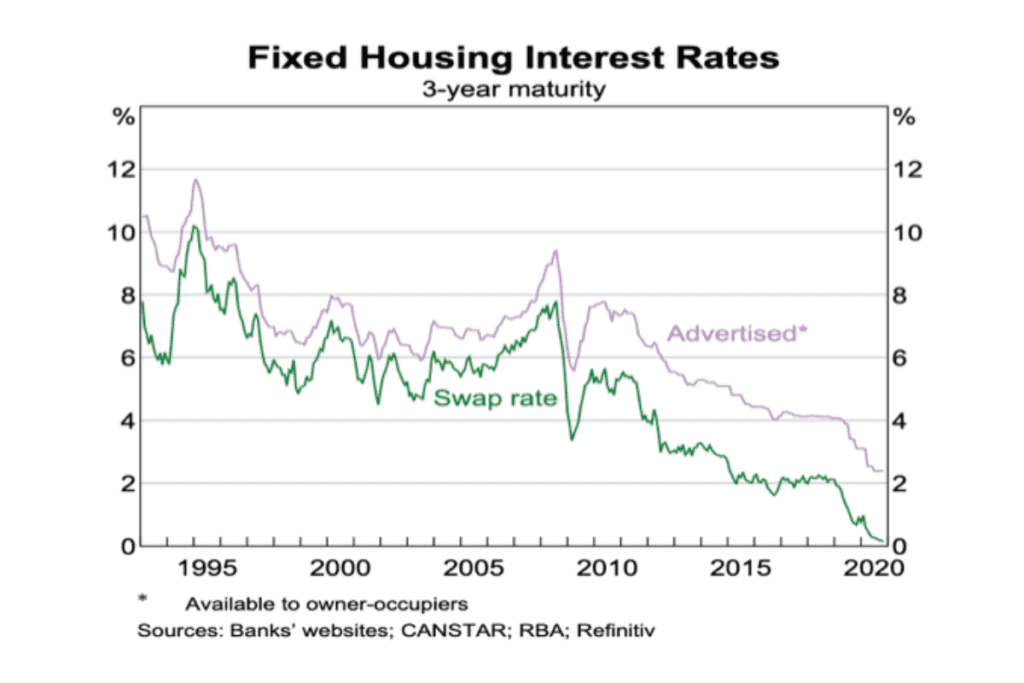

Right now, the marketplace is already swinging from a buyer’s market into a seller’s market, with property prices rising and interest rates continuing to fall.

Undersupply of housing

The undersupply of housing Australia has experienced for some years has resulted in pent-up demand for affordable and appropriate accommodation.

The growing demands for housing in general, coupled with many people’s ability to work remotely, will continue increasing pressure for available stock.

With 75% of the country (52 Australian towns) in undersupply, we will see a robust marketplace as I forecast, and which has already begun to return.

Supply and Demand

The price of anything is determined by supply and demand. Naturally, if the supply of something is limited and exceeded by demand, prices will increase.

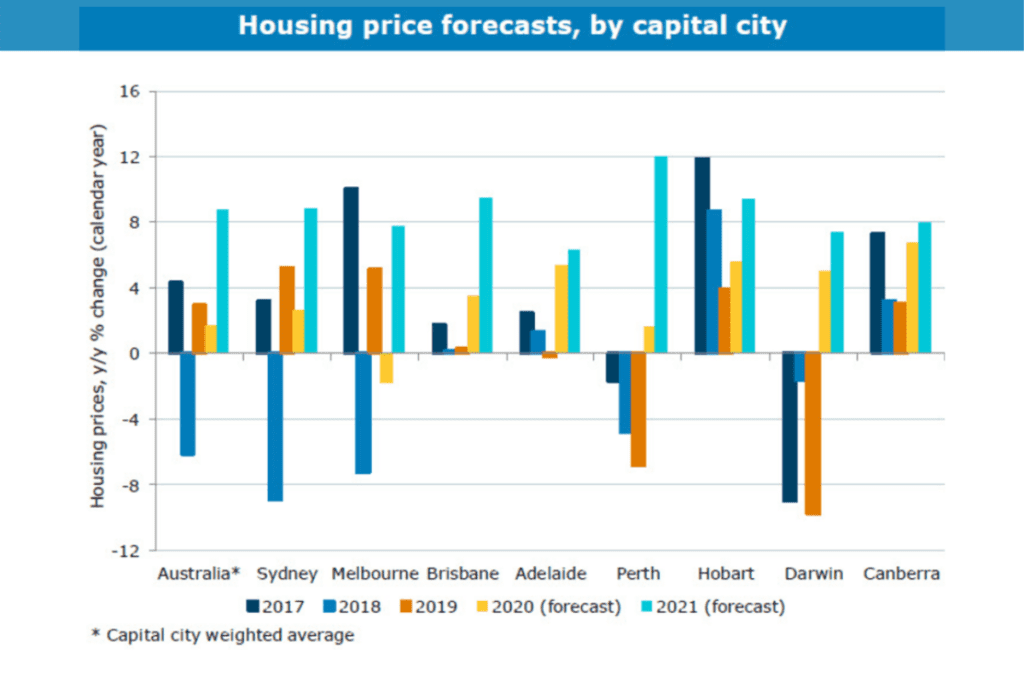

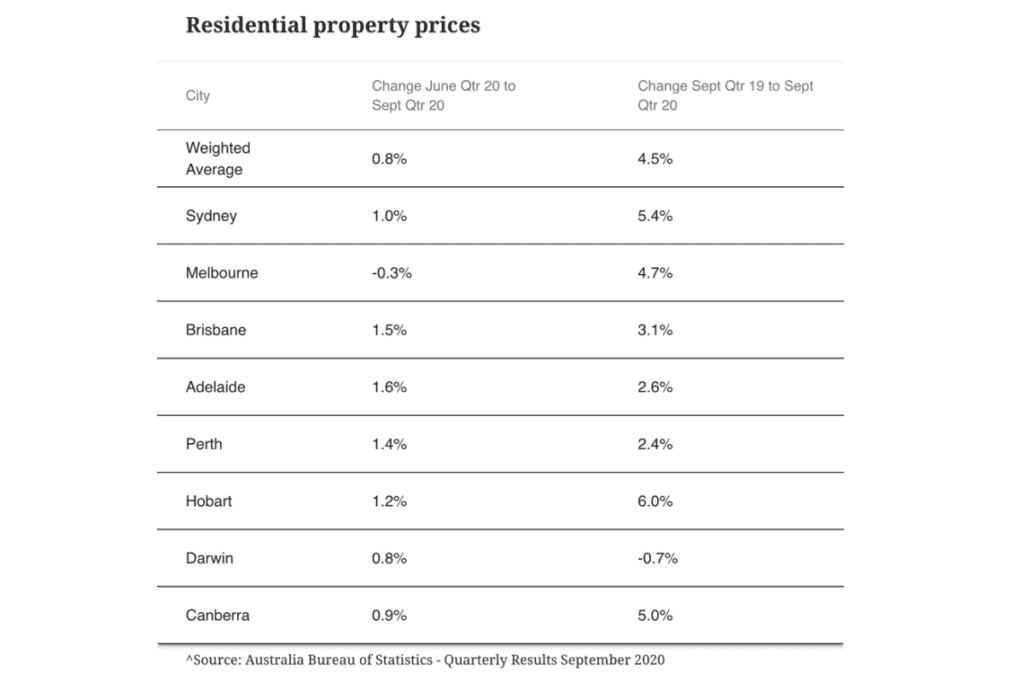

With the current undersupply, we already see an upward trend in the market, far beyond the expected forecast, as you can see in the chart below.

Vacancy rates

With the forced outcome of people working from home, we see the decentralisation of larger urban areas to affordable locations.

Across the board, vacancy rates are the lowest they have been in many years. Combined with the fastest growth in recent history, there will be continued growth in regional areas over the next 18 months.

In addition to internal migration, once borders are open to approved immigrants, they will further add to the demand for affordable housing to purchase or rent.

Growth Areas

Because of these demands, another Property Market trend we will see over the next period will be a continuation of the growing movement North from the Southern states.

This move will be similar to the mass exodus that we saw from Sydney and Melbourne into Queensland in 2000.

Because Queensland hasn’t experienced the same growth level over the past ten years that’s occurred down South; it’s a more affordable option for people to get on to the property ladder.

This is an opportunity to look at purchasing in those areas that have lagged or dropped in growth over the past decade. Perth is an example where you can buy a property for the same price as you would have paid in 2006.

And last month, according to Moody’s, new borrowers moving into Perth only need 15 percent of household income (compared to 17.4% last year) to meet their mortgage repayments.

Lending / Borrowing capacity

In July this year, 32.5% of all owner-occupier loans (excluding refinancing) were owner-occupier first home buyers.

ABS head of Finance and Wealth, Amanda Seneviratne, said: “July owner-occupier home loan commitments rebounded with the largest month-on-month rise in the history of the series, as social distancing restrictions eased in most states and territories.”

In September, changes to responsible lending laws put more risk responsibility onto the borrower than the lender.

The greater emphasis on self-responsibility means lenders won’t be penalised if borrowers give misleading information on their loan applications.

This makes it easier for the banks to take on riskier loans and give borrowers more straightforward terms.

Effectively, this means that many people, and first home buyers, who were unable to get a loan before, will have a greater ability to borrow once the changes take effect early in 2021

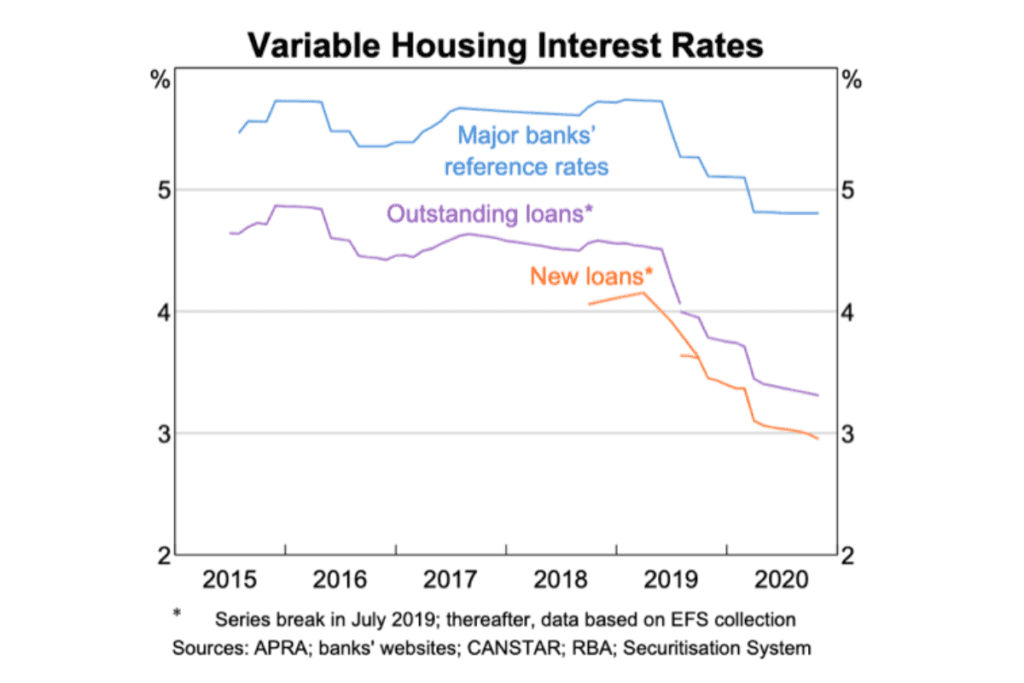

Lowest interest rates in history

With the lowest interest rates in history, we see that owner-occupiers and particularly first home buyers are driving the upward trend in the property market.

With new home lending up nearly 12% from a year ago, the Urban Developer has recently stated, “Capital city house prices hit record highs, up 4.5 percent on last year, as low-interest rates, increasing jobs and government incentives drive the residential sector.”

Even Melbourne has gained by 4.7% compared to September last year, even though it was the only capital city with a negative growth rate.

Historically, property has been the place to go for a low-risk option.

Regardless of the Property Market Trends, if you’ve got positive cash flow coming in from your investment property, you’re in a unique and stable situation.

Surprisingly, up to 80 or 90% of the standard investment properties all over the country can create more income, a lot more income.

With the right strategy, while ensuring you are cash flow positive, your investment will cover you and bring you positive returns even during economic uncertainty. You can read my must know property investment tips here.

So, especially during these unprecedented times, whether you are negatively-geared and you want to get better income out of your property or if you want to buy into property or protect yourself against future downturns, the rules for investing in property remain the same.

To learn more about the strategies I use to help protect against changes in the marketplace, you can REGISTER HERE for my free Masterclass to get started.