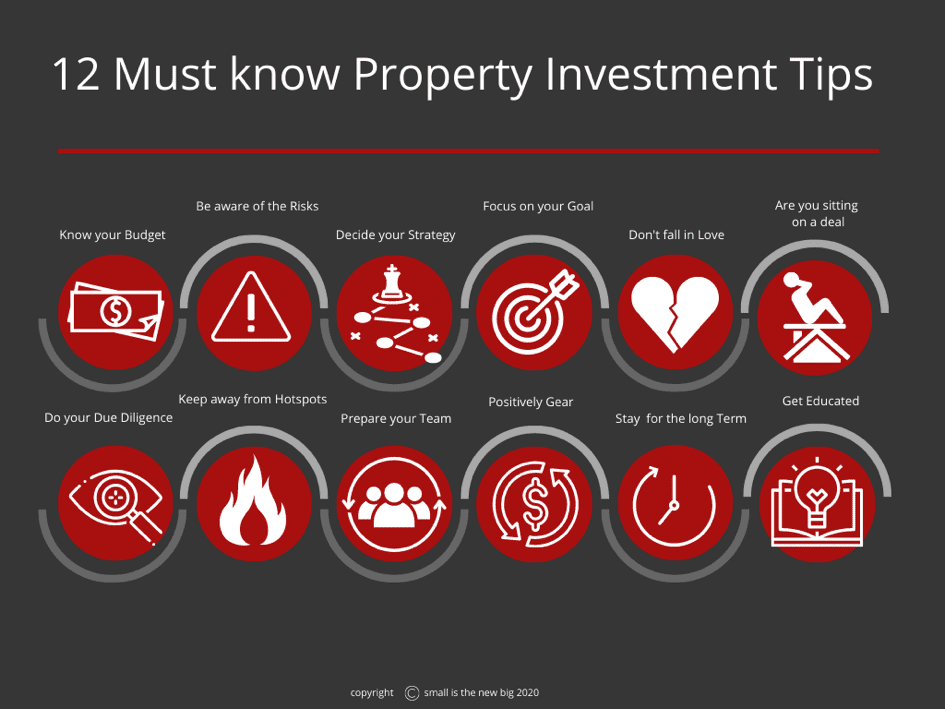

12 Must-Know Property Investment Tips

There is little doubt that buying property can build wealth, but it’s just like any other investment vehicle. You have to know what you are doing. Most people don’t, and when my wife Christine and I started, we didn’t either.

It’s painful to know that the mistakes people make with their property investment strategies could have been avoided with the right education and mentors on your side.

Here’s my Top 12 Must-Know Property Investment Tips that experts use to make sure every investment dollar works towards building a profitable portfolio.

#1 Know Your Budget

Before you even begin to think about surfing the web or visiting your local agent to find your first investment property, you’ll want to be getting pretty intimate with your cash flow.

It may not be fun, but you’re going to have to look carefully at everything that goes in and out of your account and get a perfect handle on your spending habits. Now might be the time for you to pull in the reigns on those takeaway coffees and fast food orders.

Once you’re organised, you can have a chat with your broker or bank to get pre-approval so you know how much you can borrow.

Calculators (like this one) are great for establishing how much you can afford to borrow.

#2 Understand The Risks

Like any investment, there can be risks involved in property investment. Even if you’ve got your finances and your pre-approvals sorted, you might come unstuck if you don’t consider possible changes in the market or interest rates.

If you’re not using our strategies yet and you’ve got a standard rental property, the income from rent may not meet your expectations, or the property’s value may decline.

All of these will affect your ability to hold your asset and generate cash-flow.

# 3 Get Clear On Your Strategy

Do you want a home to live in and wait for the value to increase for your retirement? Although a pretty safe option as far as property Investment strategies go but not how you will build a super portfolio.

Maybe you want to take advantage of capital gains or think that ‘flipping’ will satisfy your inner creativity and give you a quick return.

How about investing in something that will give you super rental returns? If you’ve ever joined my webinars or live seminars, you’ll know that getting and holding this last one is by far my favourite property investment strategy for positive cash flow.

WANT MORE PROPERTY INVESTMENT TIPS? Read about my first rule of investing here.

#4 Focus On The End Goal

So, let’s say you want to build a property portfolio and create a passive income of around $100,000 in 10 years. Put together your plan and begin writing out your goal. Next, take your ideas about what you want to achieve to your broker and your financial planner or adviser.

They will help you understand what things you can implement to move forward and what can affect your borrowing capacity and ultimately hold you back from your goals of building a healthy portfolio.

Although it seems a simple thing to do, many people forget to start with a clear end goal in mind.

#5 Don’t Fall In Love

When you’re looking at an investment property to buy, please don’t get sucked in by that sunken bath or the peaceful location that you think is fabulous.

Falling in love with a property is just what that estate agent wants. Ideally, they are looking for two or three prospective buyers to fall in love with the same property and push up the price.

It is also why auctions work so well – people get carried away and keep bidding even when the price surpasses their budget.

Falling in love with a property means you will almost certainly pay more than you should, and you will also struggle to let go when the time is right – both can be costly. Remember that the number one goal of every transaction is to move you forward financially.

#6 Do Your Due Diligence

Due diligence means investigating everything about a property that could affect its capital growth and its suitability for your chosen strategy. Spending a little extra time researching the right area early on can save you a lot of time and money down the track.

Asking the following questions will give you a pretty clear indication of whether buying this property is the right way for you to go.

Finances:

- Mortgage – Could you afford the repayments if interest rates were up 2 %, or if your income or cash-flow changed?

- Purchase Price – Have you made a comparison of similar properties in the same area? Is this property priced competitively?

- Refurbishments – Will you need to put in extra finance to do any renovations, maintenance, or repairs?

Demand:

- Is it appealing to multiple buyer types?

- If you want to rent it out, is there a healthy demand in the area, and will you be able to sell it quickly if you need access to the cash?

Location:

- Neighbourhood – Is the house in a desirable area of the suburb? What kind of neighbours will you have?

- Infrastructure – Is it located near the shops, schools, and good public transport connections? Also, check with the local council to see if more infrastructure is planned for the future.

- Amenities – Are there cafes, restaurants, and the opportunity for leisure activities close by?

- Development – Is there a lot of future development planned for the area? What Will this affect the value of the property?

Property:

- Zoning – Check with the local council to see if there are restrictions on what can be built on the block.

- Rooms – Are all rooms marketed as bedrooms or living spaces considered habitable spaces under council regulations? A lot of houses raised in the past were slightly shy of legal habitable height.

- Renovations – Have renovations been done, or buildings added? Have they all had council approval?

- Easements – Are there any shared access points on the property? An easement is the right over another person’s land and usually there to stop road access being blocked. A Title Search will tell you whether any shared driveways or access points to the property you need to know.

- Ownership – Is it a strata or company-titled? Is it subject to an owner’s corporation? Suppose the property is part of a subdivision with common property, such as driveways or grounds. In that case, it may be subject to an owner’s corporation, which usually means fees, rules, and restrictions on what you can do.

#7 Don’t Go For The Hotspot

Think 4-bedroom, two-bathroom – house and land packages in estates that crop up everywhere.

If marketers are involved in selling property, and people are talking up the ‘hot spot,’ it’s too late. This is where the big developers go in, do their thing, make their money, and then get right out!

If there are glossy brochures that advertise your prospective property, then you are in the wrong place. By the time you get in, they’re already in another ‘hot spot’ building up a new frenzy of interest and activity that artificially inflates the area.

#8 Have A Super Team

Whether you’re just looking to get started in the property arena or already have a portfolio, you will need to have access to your carefully chosen Licensed Professionals team.

Developing a relationship with each of them will mean they understand you and your property investment strategies, and you’ve created a super team that will look after you.

- Mortgage Broker – Your broker can help you understand the options of loans available for you and negotiate with lenders for your loan and take care of the process through to settlement. Their understanding of the finance products available means they can choose the best one for you, your property investment strategy, and your situation.

- Financial Advisor – Your financial advisor works with you to determine your financial goals and layout the plan to achieve them.

- Conveyancer – You don’t have to have a conveyancer. Still, when you’re purchasing a property, their help with all the complicated paperwork will help settlement be a much smoother and less stressful experience.

- Real Estate Agent or Buyers Agent – Real Estate Agents have an interest in working for the seller of a property. Understandably, the higher the price of a property, the more commission they’ll earn. Someone great to have on your side here is a buyers’ agent. A buyers’ agent (or buyers’ advocates) is a licensed professional who specialises in searching, evaluating, and negotiating a property’s price on your behalf. (You can find out about our Do it For You (DIFY) service here.)

- Building Inspector – It wouldn’t be fun to find that underneath that beautiful exterior is a termite ridden frame ready to collapse. Having a Building Inspector who you trust will help you know if the property is structurally sound and prevent unexpected and costly repairs needing to be done once the property is yours.

- Property Manager – It can be tempting to manage your property yourself, but if you don’t have the time or the knowledge, it’s risk-laden, stressful, and ineffective. Having a good Property Manager will mean your property is looked after and stays rented with good tenants.

#9 Only Positively Gear

Forget about the tax you might save – if the property is costing you money and eating into your income or salary, then it’s keeping you in a job, not liberating you.

I would strongly suggest that you only buy properties that are ‘cash flow neutral’ or ‘cash flow positive.’ In other words, they pay for themselves without any additional cash injection from you, or they make a profit straight off the bat.

WANT MORE? Read how positive cash flow future proofs your property investment.

#10 Be In It For The Long Term

As long as a property is positively-geared or cash flow neutral, I’d strongly suggest you hang on to it.

Not only will you benefit from capital growth over time, but the property will start working for you by creating residual income through rent. If you can hold a property in Australia for longer than ten years, you can usually see your equity and wealth double.

If you bought in the peak of the last 50 years (around 1988 – 89) and held that property with positive cash flow, by 2004, the property would have tripled in value.

Right now, it’s the same. The property market is where you get cash flow, and your wealth creation happens over a period of many years. Equity grows your wealth. When you retire, you have plenty of wealth in your name. Real wealth comes from the accumulation of assets, not trading them.

#11 Check If You Are Already Sitting On A Deal

The way to get manual growth on the property is by doing something to increase its’ return. You may think this means just renovating but using the flipping strategy is not necessarily the best approach.

As I just mentioned, the wealth creation you will see in your lifetime is from holding onto property, not trading it. It won’t be by buying, doing something to it, and then selling it. But for you to be able to hold it, you will need cash-flow.

Creating that cash-flow from the actual property itself is much more than renovations.

You may already be sitting on something that can offer some further possibilities. Some questions to consider might be:

- Is there potential for a secondary dwelling, or can you have a duplex on that block?

- Can you create a duplex secondary dwelling or a type of house that has more potential?

- Can you use the new and unknown policies around the country that allow you to transform those properties into micro-apartments with self-contained areas such as; a kitchen, sitting area, lounge room, bedroom, and a communal space?

#12 Get Educated And Learn From The Experts

You may think that having a little bit of information and then going out and buying something will put you in a better spot.

From my own painful experience, I can tell you, it won’t, and you’ll end up making a lot of avoidable and costly mistakes. By the age of 32, I had seven properties, but I was far from having ‘financial freedom.’ It was the complete opposite, and I was forced to sell at a $300K loss.

After investing in my education, I switched my mindset and my property investment strategies around. It was only 13 months later that I was financially stable enough to leave paid employment – for good!

Education is number one, and neglecting that is the biggest mistake you can make. Learn how my education with the right property investment strategies turned my portfolio and my life around.