Worried about a recession?

Here’s how to future-proof your investment property with Positive Cash Flow.

As an investor, it’s understandable if you are questioning how you are going to ride out the latest storm or you maybe you’re wondering if it’s still possible to get started in property investment as a side hustle? COVID-19 has brought lots of uncertainty into the property market, but it may secretly be the opportunity for you to see double your returns or even more.

Is it still possible to make property investment your side-hustle?

There is so much talk of doom and gloom in the economy and financial markets, and yet historically, the Australian economy has proved that it’s one of resilience.

What will come next will be primarily determined by the level of restrictions to come and how long they will continue.

What shape will our economic recovery take?

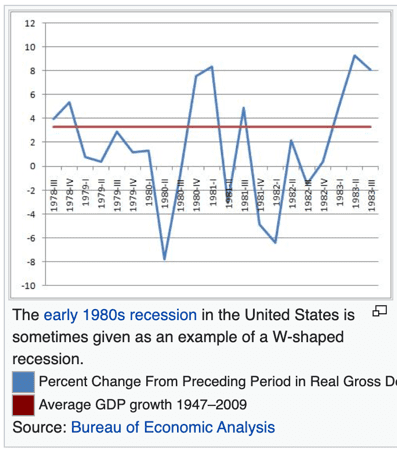

I have been predicting a ‘V’-shaped recovery although it may very well turn into a ‘W’ if a strong second wave of the virus forces strict lockdowns again we won’t know the exact outcome until we’re in the recovery phase.

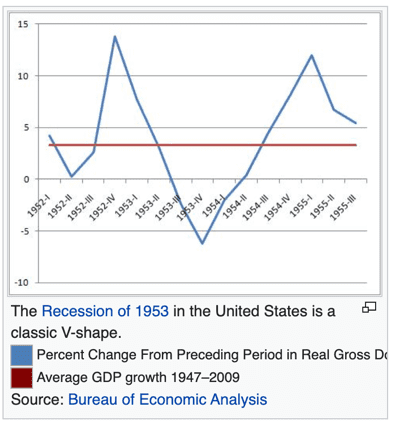

V-shaped Recovery

A V-shaped recovery would be the best outcome. It starts with a sharp drop that is immediately followed by a correspondingly sharp recovery. The government stimulus packages support this type of recovery with people having money to spend.

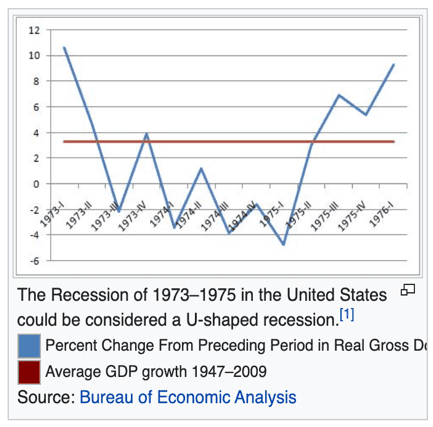

U-shaped Recovery

This type of recovery is similar to a V-shaped recession, but it takes longer to return to its previous growth level.a

W-shaped Recovery

It starts by looking like it will be a V-shaped downturn but then falls again after a false sign of recovery, and the economy drops twice before it comes back to its previous growth rate.

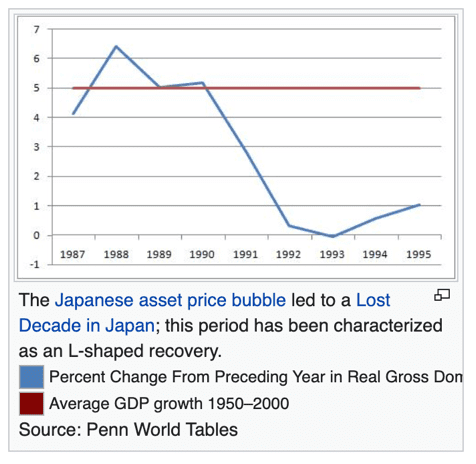

L-shaped Recovery

This is the worst-case scenario. Also referred to as a “depression,” an L-shaped outcome is when an economy experiences a deep recession and does not recover its previous growth rate for several years.

With recent events, the big question on everyone’s lips is, ‘Should we start or continue to invest in the property market?”

If we take a step back for a moment, we will see that even though we had a crash and one of the worst price slumps in 40 years, Sydney and Melbourne had just come off a boom.

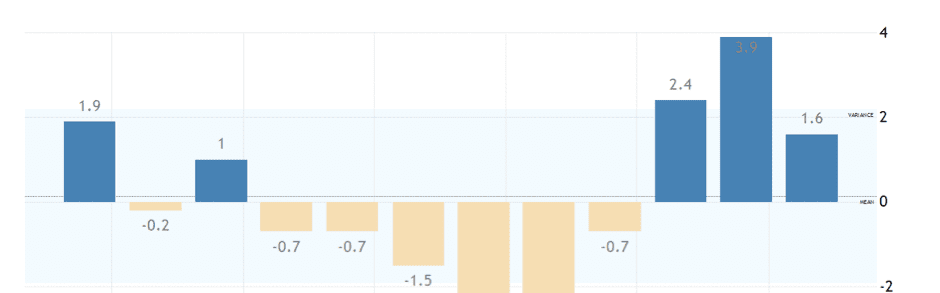

The house price index came back 2.4 percent quarter-on-quarter in the three months to September 2019 after a decline of 0.7 percent in the previous period.

But by October, prices had mostly recovered with buoyant sentiment and an even healthier market. It was the most significant jump in prices since the last quarter of 2016

WANT MORE? Discover more about the market and shape of recovery in my webinar Matter of Fact Webinar.

Then, we saw that the house price index in Australia rose by 1.6 percent quarter-on-quarter in the first three months of 2020

So, even though we have seen a drop in the capital areas, mostly Sydney and Melbourne, Sydney house values are still up by 13.2 percent over the past year, and Melbourne house values are still 8.9 percent higher than a year ago.

What’s the risk?

Historically, property has been the place to go for a low-risk option. With the right strategy, while ensuring you are cash flow positive, your investment will cover you and bring you positive returns even during times of economic uncertainty.

Besides being able to achieve healthy capital growth, property investment also gives you the benefits of financial leverage, depreciation schedules, and generous tax advantages.

Regardless of whether your investment property’s value goes up, down, sidewards or any direction, if you’ve got positive cash flow coming in from that property, you’re in a unique and stable situation.

Surprisingly, up to 80 or 90% of the standard investment properties all over the country, can create more income, a lot more income.

Whether your circumstance is that you are negatively-geared and you want to get better income out of your property or if you want to buy into property or, you want to protect yourself against the downside.

Even If you don’t have enough money for a deposit and you want to get yourself into an investment property, there is a strategy that you can use to achieve significant returns from a positive cash flow property for an amount as small as $15,000

Let me explain

In Australia, we build houses that are way, way too big for what we need. Surprisingly, even though our families have been getting smaller with the average household size now only two and a half people, at the same time, our houses are getting bigger.

The data has shown that the unused and empty rooms in these houses equate to 12 million empty bedrooms.

So if we’ve got 12 million empty bedrooms and only two and a half people in a house, why is it that people continue to build and buy four-bedroom dwellings as investment properties?

It’s important to point out here that I’m not talking about your own home. You can choose to live wherever you want.

But if you’re going to be an investor, you have to cater to the marketplace. And it’s an important question to ask what the market place is.

Right now, 60 to 80% of the people who make up a household and are currently looking for somewhere to live are singles and couples.

At the same time, the majority, yes – 60 to 80% of the properties available for them to rent are three, four, and five-bedroom houses.

And this is where I’ll introduce you to a strategy where you can use those larger houses or build homes with the adaptability to cater to those singles and couples specifically.

SCROLL DOWN TO SEE MY POSITIVE CASH FLOW STRATEGY.

What does that mean?

It means that we can create a comfortable way for singles and couples to be in those larger houses by creating micro-apartments within.

Using this type of strategy, you are giving that significant cohort of singles and couples the opportunity to save one-third to one-half of their typical weekly rent.

In turn, that proportion of savings means that those people can save money towards buying their own house in the next three to five years.

This is excellent news for you as an investor.

You are protected against the effects of any downturn in property prices because even though your tenants are only paying a third to a half of average weekly rent, it’s multiplied by four, five, six or maybe, even more (depending on the number of people who will stay in the house).

You have now got multiple incomes from the one property. And it’s a positive cash flow property.

You will double your income, day in and day out.

Your tenants win, and at the same time, you win. Because with this strategy, you double your income, or you increase your returns by $300 to $900, or you achieve double-digit returns from your residential property.

And it’s low risk!

I’m not talking about the scary and high-risk commercial arena. I am talking about residential property where people need to live.

People not only love living in them; they love the benefits that type of accommodation gives them.

Who would live in a house like that?

Contrary to what many people may think, it isn’t the lower social demographic who wants to live in this type of housing.

It’s doctors and nurses and young professionals. We are talking about those people who want somewhere to stay.

Also, there is the 55 plus single female, the most significant growing demographic of homelessness in the country.

And now, we have a growing number of people who have had their hours reduced but need to live near their work, and more than ever need somewhere safe and affordable to live.

These are the people that stay in the properties that we own.

Housing affordability is determined by the available supply of home versus the demand.

In an upside-down marketplace, the need to create smaller accommodations at an affordable rate is the essential thing that needs to happen in the housing market.

My purpose in this blog is to let you know that this strategy is out there and that it will protect you during uncertain economic times.

Realistically, the only way to future proof your investment so you can weather a degree of market volatility is to make your property adaptable.

It will protect you against an upside, and it protects you against the downside. It protects you against the properties moving sidewards, regardless of what the changes will be in property prices, the income will always be coming in.

We are working to correcting the mismatch in the market. It may take 5 or 10 years, but now is the time for you to get in and get the best result from your investment property.

You can achieve these results with positive cash flow property, using a straightforward strategy.

You can apply this all over the country, and you can also do this in every state, in most jurisdictions without even needing to go to your local council to get approval.

Yes, there are some upgrades, and some work to be done to the property, but it’s not huge and doesn’t cost a lot of money.

You can get into some of these properties yourself, and there are ways that you can even use a property you don’t own but rather rent.

With any investment, there is always an element of risk, but, unlike other markets that may offer faster returns, you are not likely to see anyone lose their investment dollars overnight in property.

As we’ve seen again with other investment alternatives like cryptocurrencies, stocks, and shares, cash or bonds, the volatility of those markets is certainly not for the faint-hearted

I always say, but now more than ever during this phase in our economy, getting yourself into a position where you have positive cash flow property is the safest way to have property investment as your side-hustle.

LEARN how you can ride out any storm and quickly generate Positive Cash Flow through property. Click here to register for my Free Webinar Masterclass to get started.