Give me 10 minutes, and I’ll give you the truth about Negative Gearing.

So, I’ve got your attention! And if you’re like most Aussie property investors who took their accountant’s advice and jumped in the negative gearing bandwagon with the promise of hefty tax offsets luring you in, you might be questioning your decision. Shelling out money on holding costs each month just to hold onto your property is at best not a lot of fun, and at worst, it can put you under extreme financial stress.

But firstly, what is Gearing?

Gearing your property is when you have borrowed money to invest. In property investment, a property can be Positively Geared or Negatively Geared.

To explain simply, Positive Gearing is when your net rental income is more than the interest on the loan for your investment. Negative Gearing on the other hand, is when you borrow money to purchase an investment property, and then the net rental income minus the expenses that you pay to maintain the property is less than the interest on your loan. The expenses or outgoings for a property are things like property management fees, repairs and maintenance, water rates, council rates, and your interest payments.

If you’re negatively geared, you’re ‘in the red’! So this means you are on the financial back-foot right from the get-go.

If someone ever tells you that you can start with negative gearing and then end up positive at the end of the financial year, I’ll tell you that it’s impossible. You can’t be half pregnant. You’re either pregnant, or you’re not!

In my mind, negative gearing was NEVER a good idea. It just doesn’t work in the current market. The reality is that negative gearing is essentially paying $1 in loss to get around 30 cents back, or your tax back.

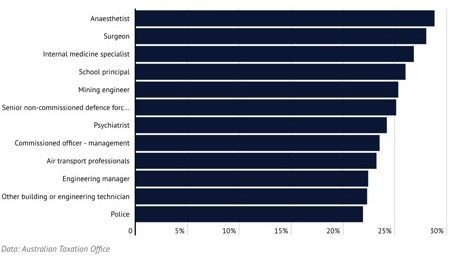

Property investors who negatively gear use this strategy to reduce their income taxes by deducting the loss they’ve accrued on their investment property from their total taxable income. Those on higher than average incomes are more likely to apply this strategy.

Some investors wait for capital gains while reducing their income taxes for several years before selling the property for profit.

So what’s the problem?

Well, the significant risk lies in having to rely on a market Increase happening. Because the way people make their money from the negative gearing strategy is from the increase in the value of the property when the market goes up, and hence taking advantage of capital gains. Unfortunately, many investors keep believing that tax deductions are better than profits.

Here’s an example

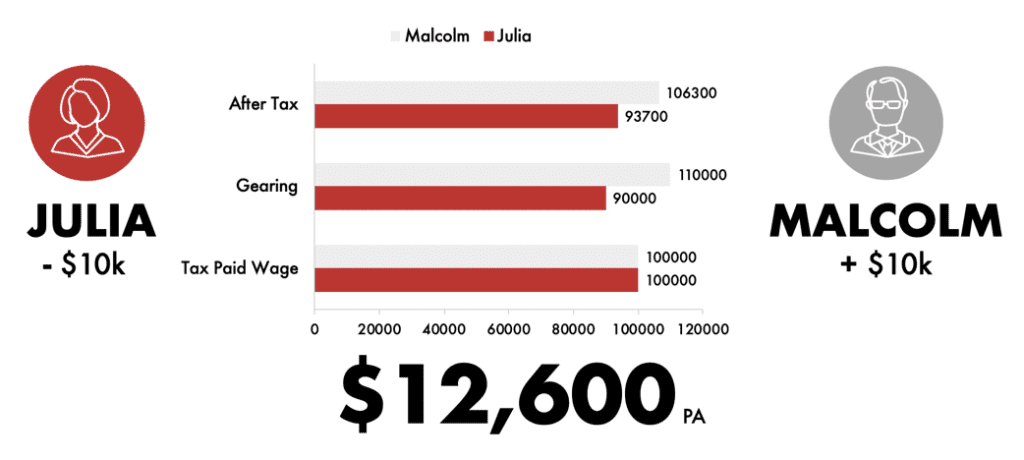

- I buy a property with a negative $10,000 cash flow.

- At the end of the financial year, I have $10,000 less in my bank account.

- I send in my tax return to get my $10,000 back from the ATO

And the reality:

- You will only get the tax back on the loss that you’ve incurred.

- Depending on your tax bracket, and let’s say most people are around $100,000, the tax paid would be $6,300, giving you only $3,700 back.

At this point, some people might think they can depreciate, and yes, that is possible, but you can also do that if you’re in a positive cash flow property situation.

Now here is the alternative scenario.

Imagine you were making $10,000 net positive cash flow from a property (after all costs).

- After paying an agent,

- after paying your maintenance,

- after paying interest on your mortgage,

- after paying anything else required on that property.

At the end of the financial year, you will have $10,000 left in your bank account.

- With that $10,000 in your bank, you lodge your return with the Australian Taxation Office via your accountant.

- Now, you have $10,000 more in income, enabling you to get in a position where you are moving forward with serviceability and increased revenue.

- Your accountant will let you know how much tax is due.

- Once you pay $3,700 in tax, you will be left with $6,300 in your bank account.

- In addition, you can depreciate and can claim extra costs on your property as well.

You tell me which position you would rather be in? Would you rather have lost $6,300 or gained $6,300? I don’t think the answer to that one is too hard!

If you’re lucky, you’re just starting out, and don’t have any investment properties yet.

But if you have already started your property investment journey, there’s a good chance one of your properties is negatively geared. This will most likely be because someone told you that you could take advantage of a tax reduction.

I understand, as my wife and I were in the same boat.

Here’s a bit of our story …

I was continually chasing the ‘big deal’ that would ‘set us up for life.’ It wasn’t long before we had seven properties. We were in that top 0.07% of Australians that owned more than six properties.

At that time, all but one of the properties we owned was negatively geared. To make matters worse, we were $36,000 ‘in the red’. Our size-able portfolio equated an even bigger problem. Every week I was scrambling to come up with nearly $700 that was needed to cover the expenses.

We were trapped in fear and Insecurity!

I had my wife and three small children to support, but we were being bled dry.

Not only were our properties creating enormous stress, but a new boss at work had changed the job I loved – and needed, into a nightmare. Finding a way to replace my income so that I no longer had to worry about money or be dependent on a job again was something I had to do.

Like so many others, I had believed that negative gearing was part and parcel of property investing. Every time we had struggled with money, I would decide to buy another property so I could get more tax back, and then I would have more money.

What were we to do?

I began to research, and I eventually came to see the reason we were not making any real headway. The culprit was our lack of specialist knowledge. It was also the reason our progress was stifled.

It was then that I invested in my education regarding property investment strategies and completely refocussed. I sacrificed today to gain tomorrow!

After looking closely at our portfolio, we sold all but one of our properties. Painfully, we lost $300k in the process – but fortunately, we were left with enough money to start again.

We needed to completely change the way we approached our property investment strategies, and how we thought about the property business.

Selling your property to get back on track doesn’t always need to happen. Even if it’s negatively geared, you can still turn your investment into a positive cash flow property. Can you re-examine your property investment strategies? Those same properties that were negatively geared, we turned around and brought in $300 to $900 extra cash flow within 48 hours.

Negative gearing is a trap. It traps people into a cycle of despair, insecurity, and fear. It traps you into a job you don’t want.

The good news is that there is a way forward, and the way forward is to invest in your education. Invest in yourself and your wealth by finding the right way forward. Click here to find out how!

This breakthrough is what led me to my strategy. I went from a negatively geared position, with a corresponding negative cash flow of $36,000, to being able to quit my job within 13 months.

Now, all we do is positively gear properties to create positive cash flow, and we’re not concerned about getting our tax back. We are in a position where we have better buying power, our income increases, and we are quite likely to pick up those properties with better development potential.

Don’t go out and lose money on property. Don’t go out with an ineffective strategy. Make sure that every decision and every step you make is going to put you in a better position.

You want to grow your wealth in equity, and you want to make sure you have positive cash flow. That’s what Small Is the New Big is all about.

Learn how to generate Positive Cash Flow through Property and turn around a Negatively Geared Portfolio? Click here to register for my free masterclass to get started.

Want to dive deeper? Check out my interview with my Survival Guide For Negatively Geared Investors HERE.